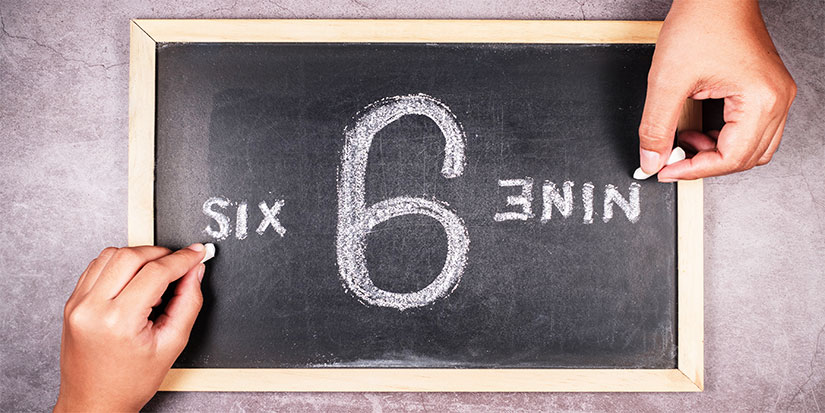

A Matter of Perspective

Things are pretty good right now. But I think most experienced market practitioners know that pain could be just around the corner.

How Much Pain Can You Take?

The market is not going to go straight up and to the right. You will experience drawdowns. Prepare accordingly.

How to Beat Food Inflation

Short answer: You can’t.

There have been some economists (like Paul Krugman) who have pointed out that the rate of inflation for food has slowed considerably in recent months. Hence, take a victory lap. But that does not tell the entire story.

The real story is that a few years ago, food purchases made up 6.5% of disposable income, and now it is 11.3%, which is the highest since the early 1990s.

I think one of the hallmarks of economic progress is that the cost of necessities goes down over time. In America, we have seen food and shelter costs go up a lot—I would not characterize this as progress. I’m sure you’ve all had this experience where you go to the grocery store and put 12 things in your cart, and it comes out to $150. I remember my first shopping trip ever: I was 22 years old in Port Angeles, Washington. A cart full of groceries was $45. The price of food has gone up a lot.

Now, this is bad for all sorts of reasons, and as I think about it, I’m concerned that food prices are about to rise even more. If people start spending 15% of their disposable income on food, there is going to be political upheaval. You might have learned this while playing Civilization a few decades ago. If the cost of living goes up significantly, you will have an uprising.

There is not much the Federal Reserve can do to make food prices go down other than engineer a severe recession, which nobody wants to do in an election year. In fact, the Fed is talking about cutting rates rather than hiking rates. I don’t spend a lot of time thinking about what the Fed should do; instead, I think about what the Fed will do. You might see a few rate cuts later this year and then a renewed hiking campaign in 2025, depending on who gets elected.

I don’t have any answers on how to beat food inflation. You have to eat. You should probably eat out less—I go out to eat about twice a week, and that is enough for me.

It’s shocking how much the price of meat has jumped. I was in the store last week, and the cheapest steak I could find was cube steak for $7.49 a pound. It’s obviously more than just the commodity itself—yes, live cattle futures have gone up a lot, but it’s also labor and processing and packing and all that stuff up and down the supply chain.

In other words, you can’t put the genie back in the bottle. It is highly unlikely that food prices will go down very much.

Budgeting

I am not much of a fan of budgeting, but to the extent that you are building a household budget, you are probably going to have a higher allocation to food than you did before, which means that you will have a lower allocation to something else, which is probably something fun.

That 5% increase in food budgets means 5% coming out of vacations. If you have $60,000 in after-tax disposable income a year, and you are spending 11% of that on food, that comes out to $6,600, which comes out to about $120/week. That’s not a lot. That’s 21 meals over the course of the week, spending about $6/meal. It’s not super hard to eat for less than six bucks—just get a can of soup or something like that. But there is not a lot of wiggle room. This budget pretty much precludes eating out—it would have to be a special occasion. The pain that people are experiencing is real. You can’t even get fast food for six bucks.

A supply-side solution would have you increase the supply of the commodity, but that’s not going to do much (for reasons described earlier), not when you have fast-food workers making $20/hour in California. Wages are sticky and generally don’t come down.

I can tell you that politicians pass minimum-wage laws like these and then wonder why food is so expensive. The minimum wage is a separate issue, but don’t think it can’t get worse—a politician in California recently proposed a $50/hour minimum wage, which is beyond parody. Our impulse to intervene in the economy has not been decreasing. There are no Javier Mileis in America.

Remember, I’m not the austerity guy, but as someone who spent the first 15 years of adulthood as a CF, I know it can be done. When the coneheads on the trading floor were ordering $40 steaks from Bobby Van’s, I was eating 69-cent pork and beans out of a can. I am not too picky about food.

If you were motivated enough, you could save a couple thousand a year on food. Better to just get another job, though.

Jared Dillian, MFA

|

Dave Ramsey and the One-Size-Fits-All Solution

Usually, when I rank on Dave Ramsey, I get back the following: “Well, he has helped a lot of people, hasn’t he?”

The Coffee Debate: Urine for a Big Surprise

Common financial advice from Suze Orman and other “experts,” like avoiding daily coffee, is wrong. Focus on big financial decisions, not the little things that just don’t matter.

Life Is Too Short to Stay in Cheap Hotels

I was in Boston last week, and usually I stay in the Seaport—the high-rent district.